Analysis on City Council Alternative Budget Proposal for Chicago FY26 City Budget

The alternative budget proposal, made public on December 2, 2025, makes material edits to Mayor Johnson’s original budget proposal introduced mid-October – some of which are a step in the right direction, with many that hold fraught assumptions, core contradictions, and an overall increased cost burden on working class Chicagoans.

At its core, this proposal attempts to do three things:

Fund the advance pension payment

Pay off the firefighters backpay

Reduce any burden-sharing with corporations, and exclusively look to “efficiencies” and regressive fees on everyday Chicagoans

On its face, fully funding the advanced pension payment and paying off the firefighters backpay without debt are positive steps to decreasing the debt and interest load of the city, but pairing that with removing a piece of significant structural recurring revenue is short-sighted, decreases the long-term financial security of the city, requires adding additional regressive fees and taxes on everyday Chicagoans, and benefit cuts for city workers, and is based on revenue and efficiencies that are missing rigorous analysis.

Diving deeper into the proposal, here are additional ways the budget proposals harms Chicagoans:

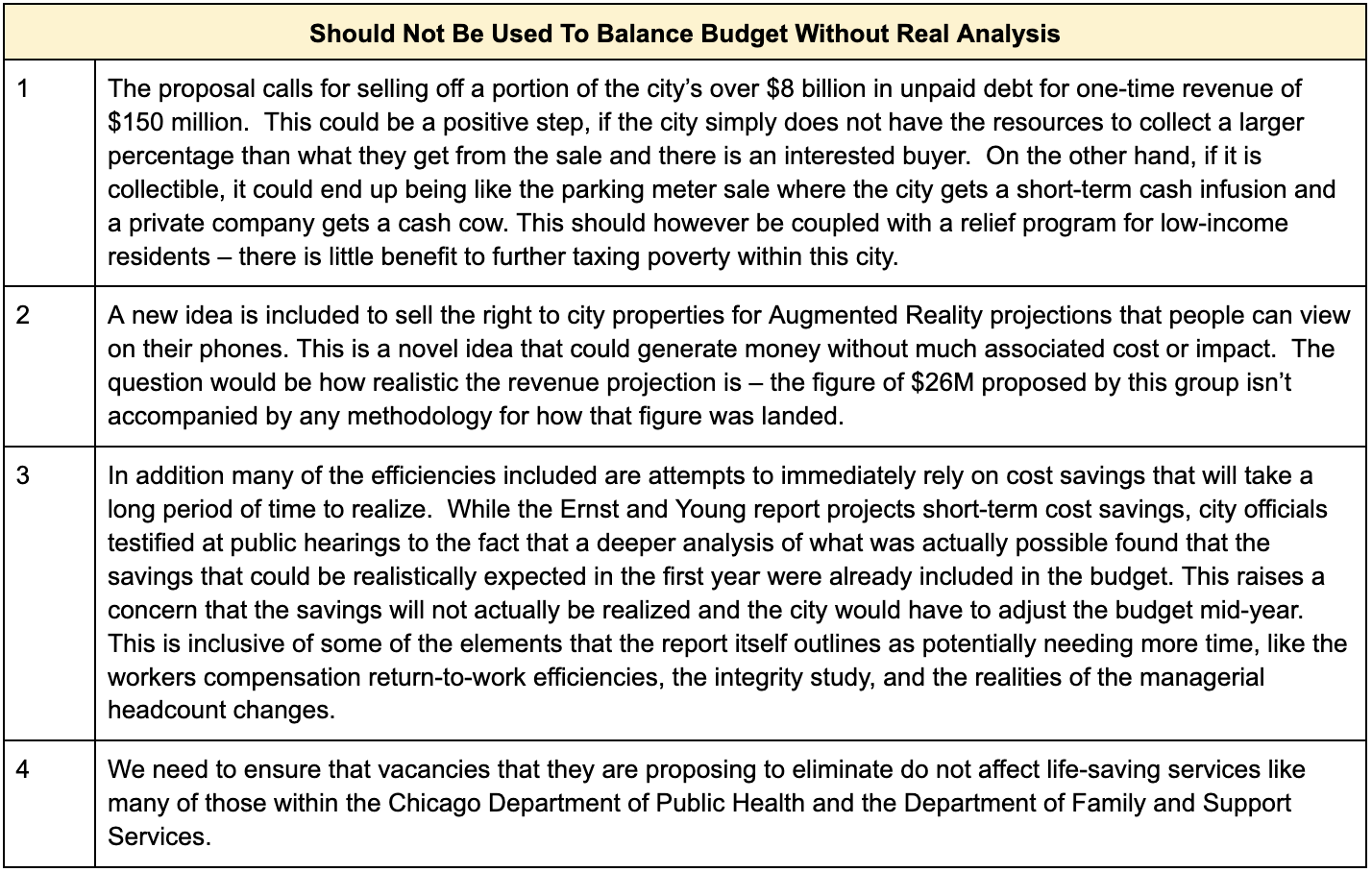

There are elements of this budget proposal that have yet to be validated with real analysis. Reliance on these partially-baked solutions could yield a mid-year budget crisis with revenues unmet, or efficiencies unrealized – due to a lack of rigorous due diligence:

This budget proposal does, however, take some positive steps:

In summary, with some exceptions, the new budget proposal is a poorly defended solution in search of a problem. The introduced budget protects critical city services and shifts the burden of closing the budget hole from everyday Chicagoans to corporations who have not been taxed by the city in over a decade. This new proposal removes any attempt at “sharing the burden” with large businesses, while imposing $85.5 million in regressive taxes and another $28.6 million in “efficiencies” that cuts benefits or pass on costs to Chicago residents that are currently covered by the city. That, coupled with finger-in-the-air estimates for both revenue and cost efficiencies engenders little confidence in the ability of this proposal to result in a balanced budget.

If the intent of this proposal is to provide a pathway to making the full advanced pension payment and eliminate borrowing for the one-time firefighter backpay – we support that, but the budget proposal does not provide a reliable nor not-harmful pathway to do so. There is, however, a pathway to do so that is sidestepped: maintain the $1 billion TIF surplus, increase the community safety surcharge, increase the PPLT, and implement some level of the positive steps of this proposal as outlined above.

Chicago has for too long relied on regressive property taxes, fees, and fines. This city needs to pass a budget that asks corporations to share in the burden of making this a city that works for everyone, and in the long run, make changes in Springfield to allow for more progressive taxation.