Analysis of the top 20 public companies that will contribute to Chicago’s Community Safety Surcharge

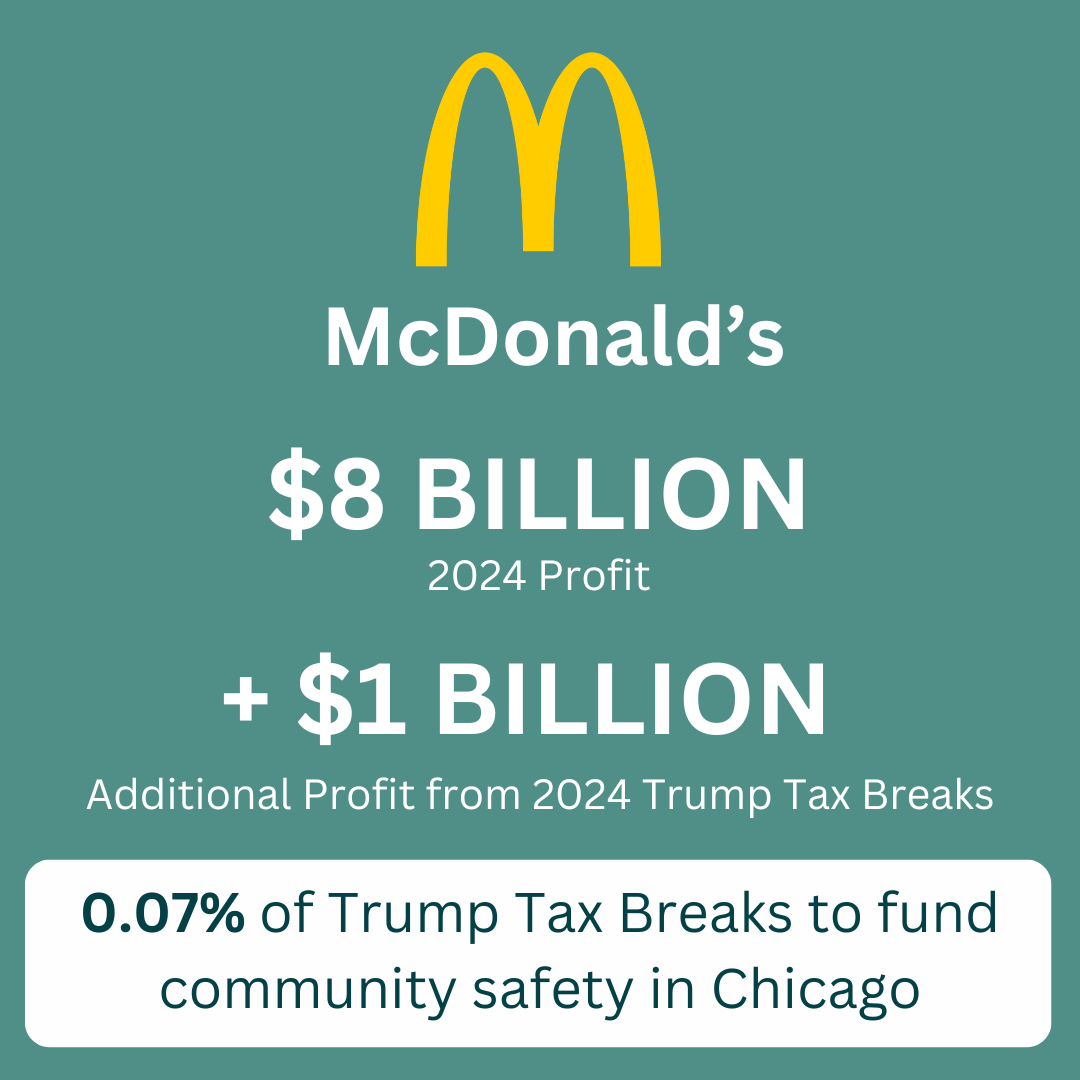

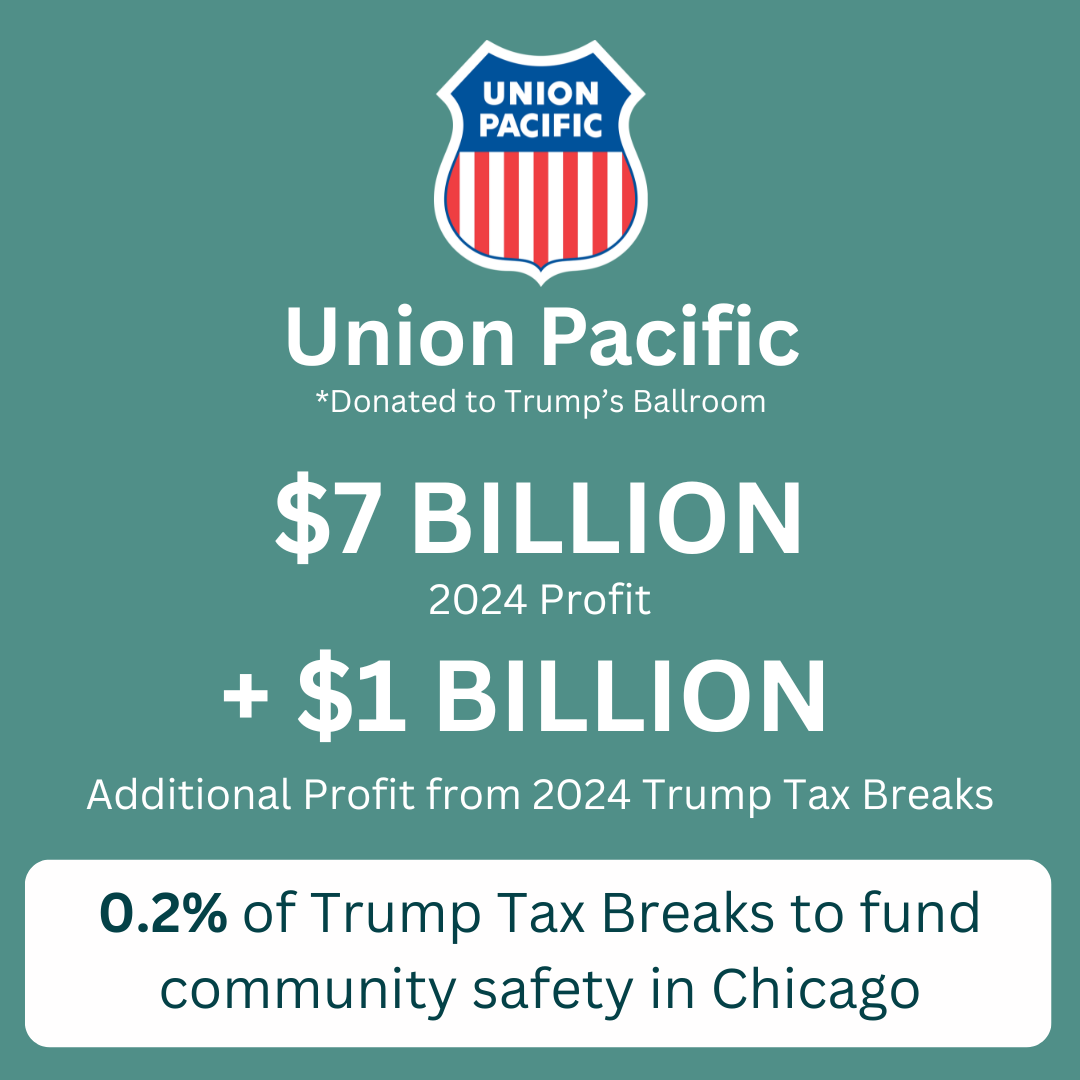

The top 20 publicly traded companies in Chicago will contribute ~20% of the Community Safety Surcharge with less than 1/1000th of the annual Federal Corporate Income Tax Cuts that they have received since 2017.

Those 20 publicly traded companies accrue approximately $323 billion in post-tax profit, with a combined $60 billion in annual tax breaks from Trump’s federal corporate income tax cuts that were instated in 2017, and reaffirmed in 2025.

A research brief from the Institute for the Public Good also shows that even with the community safety surcharge, Chicago will continue to lag behind peer cities in the level of taxation applied to corporations to fund local services – with cities like New York City, Los Angeles, San Francisco, Philadelphia, and Seattle all operating direct-corporate taxes (incl. of state taxes) that are materially higher.

The Community Safety Surcharge is a surcharge of $21 per employee per month for companies larger than 100 employees (3% of Chicago companies).

Those funds will go into a Community Safety fund used for: youth jobs, violence intervention, gender based-violence support, mental health support for first responders, and other community safety interventions.