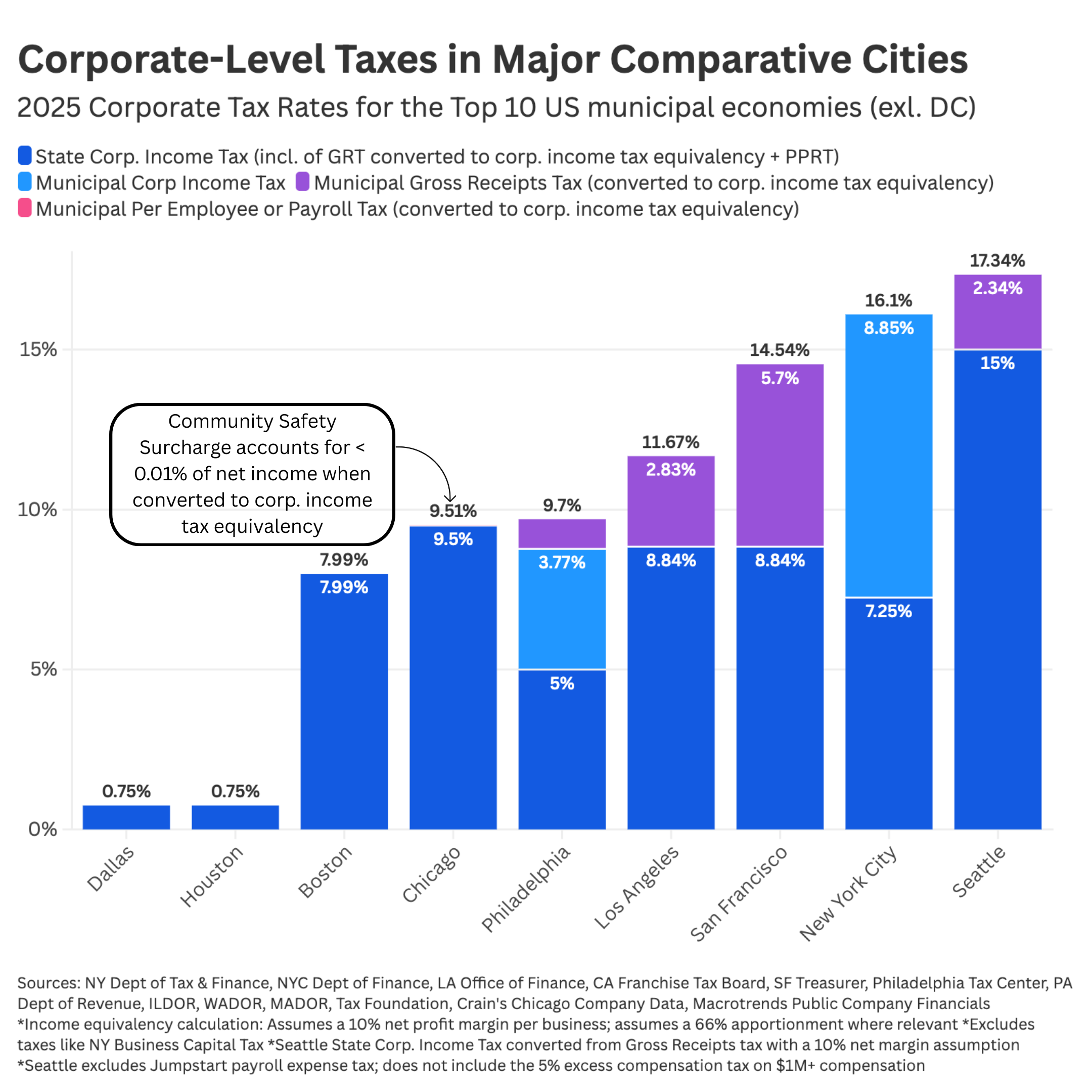

Comparative of Chicago Corporate Taxation to Peer Cities in the United States

A new analysis from the Institute for the Public Good shows local corporate-related taxing measures in each of the major 10 municipal economies across the country (excl. DC). This analysis shows that Chicago is in the bottom half of the top ten economies in corporate-level taxation, and last of the top 3 economies.

Analysis note: This analysis does not include commercial property taxes – given it does not affect all businesses and has a lack of direct comparative to an income tax structure, nor does it include sales taxes, service-based taxes, or personal property lease taxes – given those do not affect all businesses, some are passed on directly to consumers, and are highly variable by industry.

An analysis of direct corporate taxes in the top 10 local economies (excluding Washington DC, given the high volume of public activity) shows that Chicago is in the bottom half of direct corporate costs of operating a large business. Moreover, an analysis of the top 50 public companies (read about the top 20 here)that would be subject to the community safety surcharge shows that it would cost <0.01% of their net income to funding local public health and safety initiatives, yielding a net direct-corporate “cost” of operating in Chicago at 9.51% – when incorporating state income tax (7%), personal property replacement tax (2.5%) at the state level and the community safety surcharge at the municipal level.

In comparison:

New York City has both a state and city corporate income tax, yielding a direct-corporate cost of 16.1%

Philadelphia has a 7.99% state corporate income tax, and a municipal corporate income tax of 5.71%, and a gross receipts tax (meaning a tax on revenue, not income) of 0.141% (which when assuming a 10% margin business, would be ~1.41% on net income) – all yielding a direct-corporate cost of approximately 15%; when taking the rules of apportionment into account (assuming a 66% apportionment in PA/Philly), that would yield and approximate 9.7% direct-corporate cost

Los Angeles has both a state corporate income tax of 8.84% and a city Gross receipts tax (which when assuming a 10% margin business would be approx. 4% on net income), yielding a direct-corporate cost of approximately 13%; when taking the rules of apportionment into account (assuming a 66% apportionment in LA/CA), that would yield and approximate 11.67% direct-corporate cost

The notion that Chicago is a higher direct-corporate tax structure than peer economies is false. Chicago lags its peer economies in corporate taxation. And though the State of Illinois holds the majority of power to be able to dictate in what ways Chicago can tax corporations, the city does have precedent to issue an employers expense tax, and in the case of the 2026 Mayoral Budget Proposal “Protect Chicago”, this would be a structural reform to the tax regime in building revenue, and would be a positive step in building confidence with credit agencies.

Claims around corporate tax rates driving businesses out of, or hindering corporate re-locations to any given city are not borne out by the data.

The notion of corporate taxes having a direct impact on employment growth is not backed up by data. A longitudinal study by the Congressional Research Service has shown that corporate tax rates do not have a causal relationship with employment growth:

“Relationships between tax rates and savings appear positively correlated (that is, lower savings are consistent with lower, not higher, tax rates), although this relationship may not be causal. Similarly, during historical periods, slower growth periods have generally been associated with lower, not higher, tax rates.”

This point is further highlighted by the Chicago-specific data revolving around the previous repeal of the employer expense tax. As noted in the Institute’s previous report, after the repeal of the employer expense tax in 2014, there was no surge in employment within the city, and in fact, a decrease in the relative growth rate compared to the country.